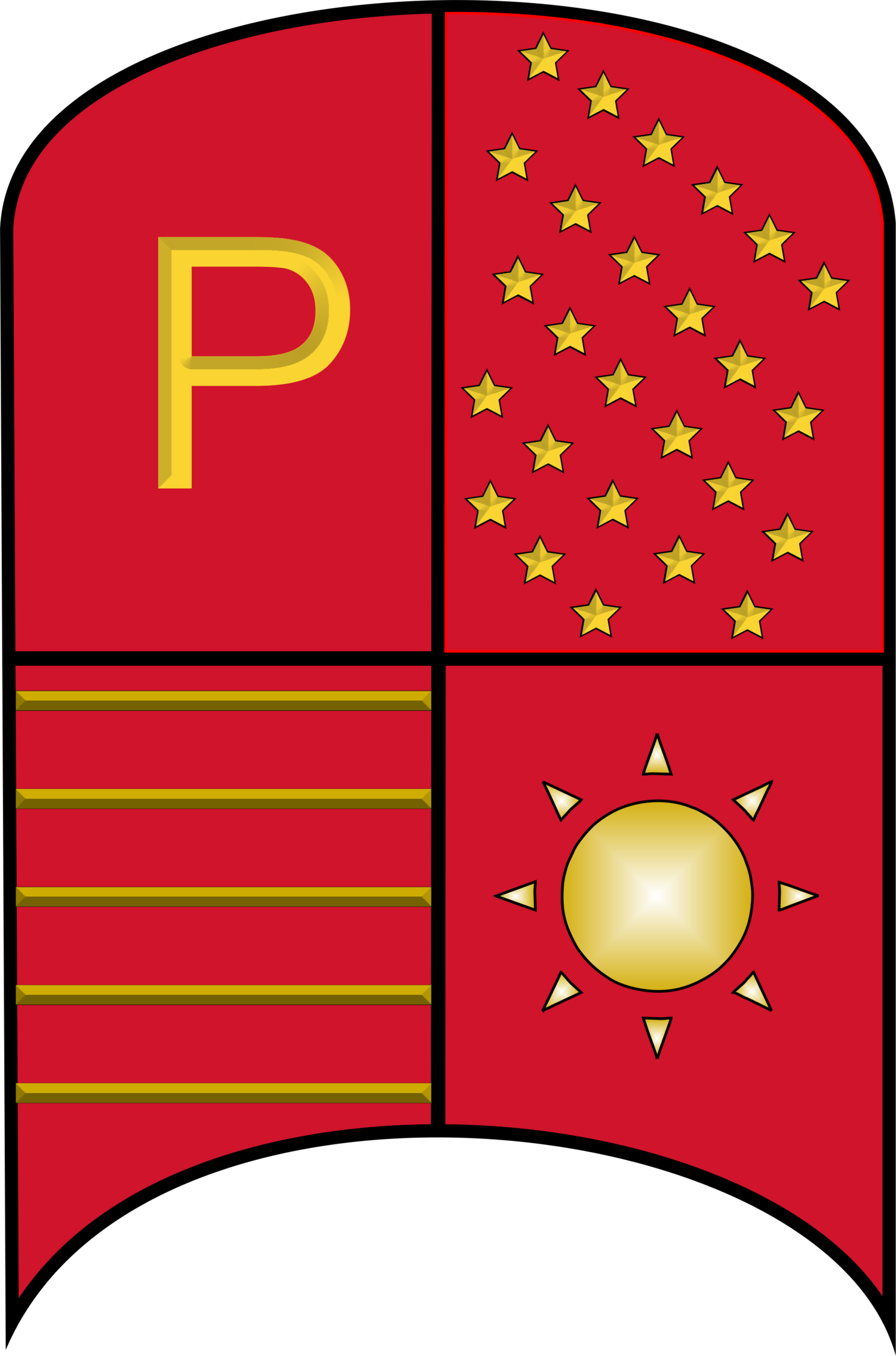

Princeton Core Fixed Income Strategy

Princeton Core Fixed Income Strategy seeks to outperform the Bloomberg Barclays U.S. Aggregate Bond Index by (1) superior security selection, (2) sector over/under-weighting, (3) yield curve positioning, and (4) duration control. The Strategy selects and locks-in superior Yield-to-Maturities on attractively-priced bonds. An income component invests in bonds for robust current yield. Sector and yield-curve positioning positively contribute to the risk-return profile. In particular, the Strategy adds value in spread sectors, namely, the investment-grade corporate bond sector. Within this sector, the Strategy seeks to capture excess return in opportunistic situations caused by structural changes in the bond markets. The Strategy is available in Separately Managed Account format.

The Strategy is ideal for pensions, retirement systems, foundations, fund of funds, family offices, endowments and individuals seeking capital preservation and current income.

Princeton Opportunistic Credit Strategy

Princeton Opportunistic Credit Strategy captures excess return in opportunistic situations caused by structural changes in the credit markets. It is expressed in two formats: (1) the Princeton Opportunistic Credit Fund, L.P. and (2) Separately Managed Account format. Due to structural changes relating to liquidity, market fragmentation, and trading imbalances, a security's market value deviates significantly from intrinsic value in opportunistic situations. The Princeton Opportunistic Credit Strategy seeks to capture this excess return offered during these periods. The investment universe consists primarily of investment-grade corporate bonds, high yield bonds, preferred stock, and international bonds that are denominated in U.S. Dollars. Typically, a near-term catalyst drives price appreciation.

Additionally, there is a cash flow component of the portfolio, consisting of preferred stock which contribute to robust levels of portfolio yield. The benchmark for the Strategy is the Bloomberg Barclays U.S. Aggregate Bond Index reflecting the higher-quality composition of the portfolio.

The Strategy is ideal for pensions, retirement systems, foundations, fund of funds, family offices, endowments and individuals seeking positive alpha.