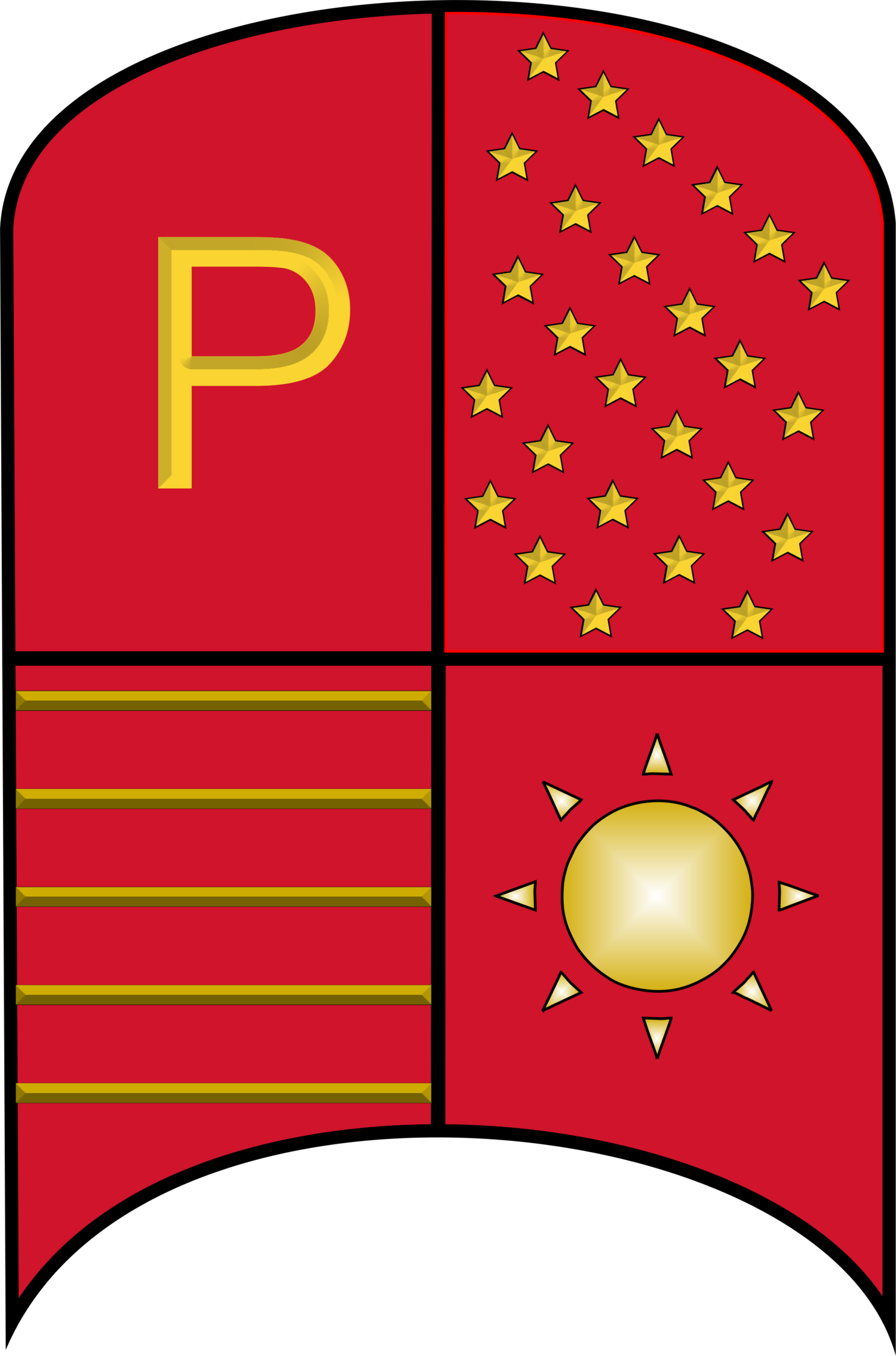

Princeton Asset Management is a Women Minority Owned investment firm focusing on fixed income and credit strategies.

Passion to Excel

Identifying attractive securities. Recognizing catalysts that positively impact credits. Conducting meticulous research. It's in our DNA. Princeton Asset Management's duty of care directs us to perform functions with a high level of competence and thoroughness. A passion to excel and add value to clients define the firm.

A Winning Strategy

Winning a race requires the right strategy and active planning. Princeton's active management is unafraid to overweight high conviction ideas. The Princeton Opportunistic Credit Strategy has withstood the test of time, navigated different market regimes, and demonstrated agility in changing interest rate environments.

Wall Street Transcript

Deploying a Catalyst-Driven and ESG Overlay in a Fixed Income Strategy

Ability to Create Alpha

Educated capital invests in strategies that generate positive alpha. With the Bloomberg Barclays U.S. Aggregate Bond Index a staple of so many institutional allocations, you may discover the Princeton Opportunistic Credit Strategy is the right fit within your asset allocation.

Radio Interview

Princeton’s Chief Investment Officer discusses interest rate outlook with MarketWatch. Click below.